If you have an electronic certificate you can electronically register your agency on the website of the Agency for Business Registers.

If you do not have an electronic certificate, you can obtain it from one of the approved certification bodies.

If you want us to register your agency, fill out this power of attorney, certify it with your electronic certificate, fill out the form below and we will register your agency. Or reach out to us by e-mail at office@pausal.rs.

Our price list is here.

OFFLINE

JRPPS FORM / APR FEE / IDENTITY CARD

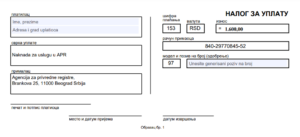

Generate a “number call” for the payment slip

Sign the form, pay the fee of 1,600.00 dinars. Sign the form, pay the fee of 1,670.00 dinars, take your ID and a copy of it with you (a print-out of the data if you have a Serbian ID card).

GO TO APR TO SUBMIT APPLICATION!

After submitting the registration application, you will receive a code (bp xxxx/2024) with which you can track the status of the registration

APR DECISION / MAKING OF STAMPS

After the successful registration, you should go to the APR for a decision and confirmation of the PIB.

Note: as of October 1, 2018, the use of the stamp is not mandatory and cannot be imposed by any regulation (Companies Act Law).

If you still want to use the stamp, then with the raised documentation at the nearest stamper.

BANK ACCOUNT

To open a bank account, you need:

- COPY OF THE APR DECISION

- COPY OF PIB CERTIFICATE

- ID card

- STAMP

- OP FORM*

If you are a foreign citizen, there is a possibility that the documentation will differ and that additional documentation will be required

*According to our research, the OP form is not required in most banks. If the form is necessary, you need to have it notarized in 3 copies.

TAX ADMINISTRATION

From 01.01.2020. no tax application is submitted!

All that is required to be a lump sum entrepreneur is to select lump sum taxation when registering in APR, and within 48 hours you will receive a tax resolution in the mailbox on the ePorezi portal.

The PPDG-1R tax return is submitted only if you start or stop employment in another company.

You can access the ePorezi portal if you have an electronic signature or you can authorize someone else to do it for you.

The obligation to pay the eco tax has been introduced for all entrepreneurs. The application is submitted through the LPA portal, which also requires an electronic signature or ConsentID mobile application. Read more about this tax here.

To authorize someone, you need to submit a filled and signed copy of the following form to the Tax Administration of the agency’s headquarters:

If you want to authorize us, contact us at office@pausal.rs, so that we can guide you on the next steps.

Thinking about the name of the agency…

Find the winning name and check HERE if it is already registered!

Check the activity of your agency

If your business is a flat-rate taxed business, get ready to go – you can find the list of business codes for which the right to flat-rate taxation is recognized here.

The right to flat-rate taxation cannot be granted to an entrepreneur:

- who performs activities in the field of advertising and market research;

- which performs activities in the areas of: wholesale and retail trade, hotels and restaurants, financial mediation and activities related to real estate;

- in whose activity other persons also invest;

- whose total turnover in the year preceding the year for which the tax is determined, i.e. whose planned turnover when the activity begins, is greater than 6,000,000 dinars;

- who is registered as a value added tax payer in accordance with the law regulating value added tax.With the exception, an entrepreneur who conducts trade or catering activities in a kiosk, trailer or similar prefabricated or mobile facility may, at his request, be granted the right to pay tax on a flat-rate determined income.

Of course, if you need help choosing a name and activity code, schedule a consultation.

Do the independence test

The independence test is the tax regulation introduced in March 2020. It is mandatory for all entrepreneurs, including lump-sum payers.

A total of 9 criteria are used to evaluate each Entrepreneur’s engagement (for each Principal, a test is conducted). As a result, you can do independent business with one Principal and non-independent business with another.

Check how the tax control would evaluate your independence in working with clients and avoid tax penalties with the help of our new tool testsamostalnosti.rs application.

If you answer “yes” to 5 or more questions out of 9, it means that you fail the test and do not meet the conditions for your income to be treated as entrepreneur income:

- The principal or a person related to the principal determines the working hours of the entrepreneur or the vacation and absences of the entrepreneur depend on the decision of the principal or the person related to the principal and the remuneration of the entrepreneur or the flat-rate entrepreneur is not reduced in proportion to the time spent on vacation;

- An entrepreneur usually uses the premises provided by principal or performs work in a place designated by the principal or a person related to the principal for the purposes of performing the tasks entrusted to him;

- The principal or a person related to the principal performs or organizes professional training or improvement of entrepreneurs;

- The principal hired an entrepreneur after advertising in the media the need to hire natural persons or by hiring a third party who usually deals with finding persons suitable for employment, and whose service resulted in the hiring of that entrepreneur or flat-rate entrepreneur;

- The principal or a person related to the principal provides basic tools, equipment or other basic tangible or intangible resources needed for the regular work of the entrepreneur or finances their procurement, except for specialized tools, equipment or other specialized tangible or intangible resources that may be necessary for the purpose execution of a specific job or order, or the principal or a person related to the principal usually manages the work process of an entrepreneur or a flat-rate entrepreneur, except for such management which involves giving a basic order in connection with the ordered work and reasonable control of the work results or supervision of the principal, as a good businessman, over the performance the work he ordered;

- At least 70% of the total realized income of an entrepreneur or a in a period of 12 months starting or ending in the respective tax year was realized from one principal or from a person connected with the principal;

- An entrepreneur performs tasks from the activity of the principal or a person related to the principal, and for such performed tasks, his employment contract does not contain a clause according to which the entrepreneur bears the usual business risk for the work delivered to the client of the principal or a person related to the principal, if such the client exists;

- The contract on the engagement of an entrepreneur contains a partial or complete ban on the entrepreneur to provide services based on contracts with other principals, with the exception of a partial ban that includes the provision of services to a limited number of direct competitors of the principal.

- An entrepreneur performs activities for the same principal or for a person related to the principal, continuously or with interruptions for 130 or more working days in a period of 12 months that begins or ends in the respective tax year, whereby performing the activity in one working day a day is considered the performance of activities in any period during the working day between 00:00 and 24:00.

You do this test with each client separately.

Thinking about the name of the agency…

Find the winning name and check HERE if it is already registered!

Check the activity of your agency

If your business is a flat-rate taxed business, get ready to go – you can find the list of business codes for which the right to flat-rate taxation is recognized here.

The right to flat-rate taxation cannot be granted to an entrepreneur:

- who performs activities in the field of advertising and market research;

- which performs activities in the areas of: wholesale and retail trade, hotels and restaurants, financial mediation and activities related to real estate;

- in whose activity other persons also invest;

- whose total turnover in the year preceding the year for which the tax is determined, i.e. whose planned turnover when the activity begins, is greater than 6,000,000 dinars;

- who is registered as a value added tax payer in accordance with the law regulating value added tax.With the exception, an entrepreneur who conducts trade or catering activities in a kiosk, trailer or similar prefabricated or mobile facility may, at his request, be granted the right to pay tax on a flat-rate determined income.

Of course, if you need help choosing the name and activity code, feel free to write to us at office@pausal.rs.

Do the independence test

The independence test is the tax regulation introduced in March 2020. It is mandatory for all entrepreneurs, including lump-sum payers.

A total of 9 criteria are used to evaluate each Entrepreneur’s engagement (for each Principal, a test is conducted). As a result, you can do independent business with one Principal and non-independent business with another.

Check how the tax control would evaluate your independence in working with clients and avoid tax penalties with the help of our new tool testsamostalnosti.rs application.

If you answer “yes” to 5 or more questions out of 9, it means that you fail the test and do not meet the conditions for your income to be treated as entrepreneur income:

- The principal or a person related to the principal determines the working hours of the entrepreneur or the vacation and absences of the entrepreneur depend on the decision of the principal or the person related to the principal and the remuneration of the entrepreneur or the flat-rate entrepreneur is not reduced in proportion to the time spent on vacation;

- An entrepreneur usually uses the premises provided by principal or performs work in a place designated by the principal or a person related to the principal for the purposes of performing the tasks entrusted to him;

- The principal or a person related to the principal performs or organizes professional training or improvement of entrepreneurs;

- The principal hired an entrepreneur after advertising in the media the need to hire natural persons or by hiring a third party who usually deals with finding persons suitable for employment, and whose service resulted in the hiring of that entrepreneur or flat-rate entrepreneur;

- The principal or a person related to the principal provides basic tools, equipment or other basic tangible or intangible resources needed for the regular work of the entrepreneur or finances their procurement, except for specialized tools, equipment or other specialized tangible or intangible resources that may be necessary for the purpose execution of a specific job or order, or the principal or a person related to the principal usually manages the work process of an entrepreneur or a flat-rate entrepreneur, except for such management which involves giving a basic order in connection with the ordered work and reasonable control of the work results or supervision of the principal, as a good businessman, over the performance the work he ordered;

- At least 70% of the total realized income of an entrepreneur or a in a period of 12 months starting or ending in the respective tax year was realized from one principal or from a person connected with the principal;

- An entrepreneur performs tasks from the activity of the principal or a person related to the principal, and for such performed tasks, his employment contract does not contain a clause according to which the entrepreneur bears the usual business risk for the work delivered to the client of the principal or a person related to the principal, if such the client exists;

- The contract on the engagement of an entrepreneur contains a partial or complete ban on the entrepreneur to provide services based on contracts with other principals, with the exception of a partial ban that includes the provision of services to a limited number of direct competitors of the principal.

- An entrepreneur performs activities for the same principal or for a person related to the principal, continuously or with interruptions for 130 or more working days in a period of 12 months that begins or ends in the respective tax year, whereby performing the activity in one working day a day is considered the performance of activities in any period during the working day between 00:00 and 24:00.

You do this test with each client separately.

ONLINE

If you have an electronic certificate you can electronically register your agency on the website of the Agency for Business Registers.

If you do not have an electronic certificate, you can obtain it from one of the approved certification bodies.

If you want us to register your agency, fill out this power of attorney, certify it with your electronic certificate, fill out the form below and we will register your agency.

Or reach out to us by e-mail at office@pausal.rs.

Our price list is here.

OFFLINE

JRPPS FORM / APR FEE / IDENTITY CARD

Generate a “number call” for the payment slip

Sign the form, pay the fee of 1,670.00 dinars, take your ID and a copy of it with you (a print-out of the data if you have a Serbian ID card)

GO TO APR TO SUBMIT APPLICATION!

After submitting the registration application, you will receive a code (bp xxxx/2024) with which you can track the status of the registration

APR DECISION / MAKING OF STAMPS

After the successful registration, you should go to the APR for a decision and confirmation of the PIB.

Note: as of October 1, 2018, the use of the stamp is not mandatory and cannot be imposed by any regulation (Companies Act Law).

If you still want to use the stamp, then with the raised documentation at the nearest stamper.

BANK ACCOUNT

To open a bank account, you need:

- COPY OF THE APR DECISION

- COPY OF PIB CERTIFICATE

- ID card

- STAMP

- OP FORM*

If you are a foreign citizen, there is a possibility that the documentation will differ and that additional documentation will be required

*According to our research, the OP form is not required in most banks. If the form is necessary, you need to have it notarized in 3 copies.

TAX ADMINISTRATION

From 01.01.2020. no tax application is submitted!

All that is required to be a lump sum entrepreneur is to select lump sum taxation when registering in APR, and within 48 hours you will receive a tax resolution in the mailbox on the ePorezi portal.

The PPDG-1R tax return is submitted only if you start or stop employment in another company.

You can access the ePorezi portal if you have an electronic signature or ConsentID mobile application. or you can authorize someone else to do it for you.

The obligation to pay the eco tax has been introduced for all entrepreneurs. The application is submitted through the LPA portal, which also requires an electronic signature. Read more about this tax here.

To authorize someone, you need to submit a filled and signed copy of the following form to the Tax Administration of the agency’s headquarters:

If you want to authorize us, contact us at office@pausal.rs so that we can guide you on the next steps.