After registration, you should receive your tax resolution on the ePorezi portal within 48 hours. To access the portal, you need an electronic signature and a card reader or ConsentID mobile application. If you do not have one of those two, you can contact us at office@pausal.rs and we will be happy to help you. 🙂

If you have everything you need, start ePorezi and once your certificate has been successfully recognized, enter your PIN. That’s how you log in to the portal. You will have the option to choose yourself as an entrepreneur.

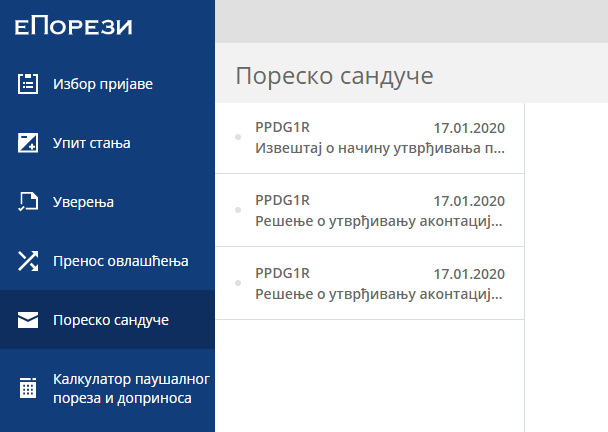

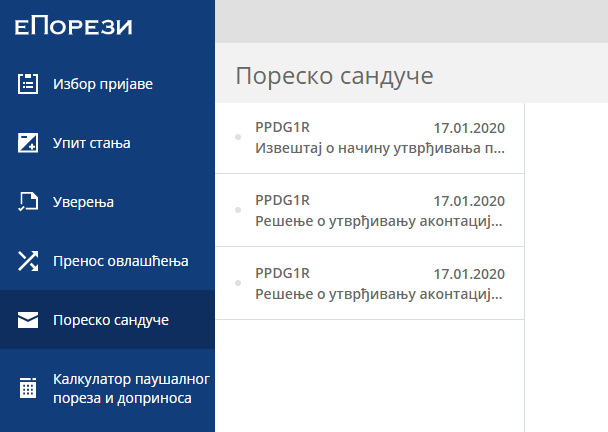

On the left side, click on the option “Tax mailbox (Poresko sanduče)” and if the resolutions have been adopted, you will be able to download them.

There should be 3 documents in the mailbox – the Report on the tax and contributions, the Decision the tax the Decision for contributions.

Payment information will be displayed on the resolution – amount, bank account and reference number. You make the payment by the 15th of the month for the previous month.

How do I download the tax resolution?

After registration, you should receive your tax resolution on the ePorezi portal within 48 hours. To access the portal, you need an electronic signature and a card reader or ConsentID mobile application. If you do not have one of those two, you can contact us at office@pausal.rs and we will be happy to help you. 🙂

If you have everything you need, start ePorezi and once your certificate has been successfully recognized, enter your PIN. That’s how you log in to the portal. You will have the option to choose yourself as an entrepreneur.

On the left side, click on the option “Tax mailbox (Poresko sanduče)” and if the resolution have been adopted, you will be able to download them.

There should be 3 documents in the mailbox – the Report on the tax and contributions, the Decision the tax the Decision for contributions.

Payment information will be displayed on the resolution – amount, bank account and reference number. You make the payment by the 15th of the month for the previous month.